How a Biden Victory—And Higher Taxes—Could Provide a Surprising Tailwind for High Yield

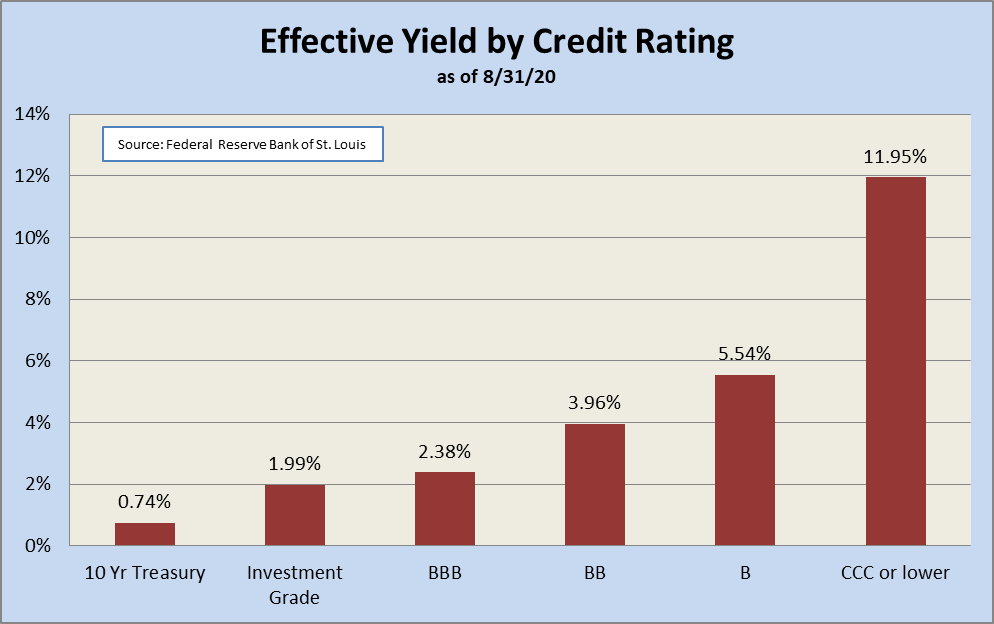

A Democratic win on Nov. 3 could bring with it the repeal of at least two key elements of the Trump tax cuts, which could boost High Yield’s appeal relative to stocks.

Read More “How a Biden Victory—And Higher Taxes—Could Provide a Surprising Tailwind for High Yield”