Fixed income is an asset where active management shines, yet most bond fund managers have never invested in a rising interest rate environment.

By Bruce H. Monrad, Chairman, Northeast Investors Trust | March 2021

Click here to read a PDF of this article.

As investor confidence in the economy has grown since the start of the year—after two rounds of fiscal stimulus with another round soon to come—market interest rates have been on the rise. Through the first nine weeks of the year, 10-Year Treasury yields shot up more than half a percentage point to 1.54%, and they’re up a full percentage point since last summer.

When interest rates rise like this, it’s only natural for bond investors to worry. Because fixed income prices move in the opposite direction of yields, the broad bond market has fallen more than 3% so far this year through early March.

However, rising rates don’t threaten all bonds or strategies equally. Fixed income funds can still make money in a rising rate environment—if they focus on the right part of the market and if their managers are familiar with the terrain. Indeed, in 2013 (when Treasury yields jumped from 1.75% to 3%) and in 2016 (when long rates nearly doubled after the Fed started raising short rates for the first time in a decade), High Yield bond funds posted positive returns even as the broad bond market lost ground. Northeast Investors Trust generated double-digit annual gains in those years. However, income investors must be mindful of a couple essential truths:

High Yield can provide some added cushion in a rising-rate environment but…

High Yield offers several advantages as rates rise. As bond prices fall, their higher coupons can protect your total returns even as the underlying value of your portfolio is threatened. And if long rates are rising because the economy is improving, High Yield stands to benefit like all risk assets.

High Yield funds provide additional protection with respect to interest rate risk: While broad-market bond funds sport an average duration of nearly 6 years, the typical High Yield fund’s duration is closer to 3, owing to the shorter maturities found in this area. Duration is an indicator of interest rate sensitivity, so this implies that as long rates rise, High Yield funds are likely to lose less value.

Yet even with shorter duration, only 5% of a High Yield index fund’s holdings are set to mature in the next 1 to 3 years, meaning passive strategies still expose you to interest rate risks because they can’t take advantage of rising rates by rolling maturing bonds into higher yielding debt. This is an argument for actively managed funds, but there’s a caveat.

Yes, active management is a better way to go but…

Active management gives you an advantage over passive strategies in periods of rising rates because your fund managers have the discretion to be more defensive, if need be, while avoiding certain securities or sectors altogether.

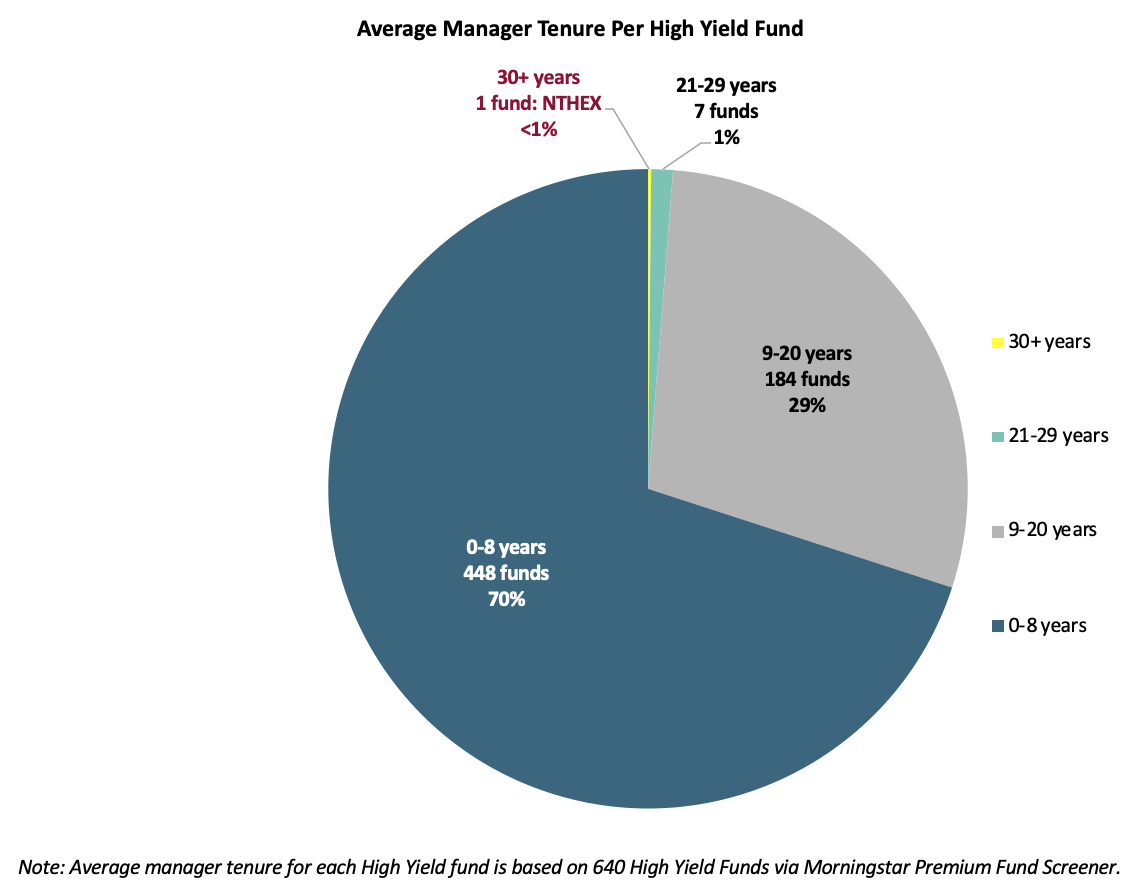

However, it’s not simple because the typical High Yield fund manager has a tenure of only around 7 years. Over the past three decades, rates have generally been falling, with most of the meaningful upticks in yields seen in the late 1980s and mid-to-late 1990s. The bottom line is that most of today’s managers weren’t around during 1994’s so-called Tequila crisis, and many didn’t even have to face 2013’s Taper Tantrum.

Our Long-Term Approach

One thing that distinguishes Northeast Investors Trust from other actively managed High Yield funds is continuity and experience. The Trust has been run by just two managers over the past 60 years, a period that stretches back before High Yield was even considered an asset class. We also adhere to a different approach to active management that’s uncommon in this segment:

We care about absolute returns, not relative performance.

Today, success is often based on how managers perform relative to their benchmark. That means they can declare victory even if they lose money in a given year—so long as they lose less than the index. We don’t want to be the cleanest dirty shirt in the laundry. Our goal is to produce income for our shareholders regardless of market conditions or the benchmark’s performance.

We invest as if the Trust represents the bulk of your assets, not just a sliver of your portfolio.

High Yield is regarded as one of the riskier parts of fixed income, and for many investors it represents a satellite holding. As such, many High Yield managers don’t feel the need to play it safe. By contrast, we manage the Trust as if it comprises most of our shareholder’s net worth. In fact, it comprises a large chunk of our own portfolios since we believe our interests and our shareholders’ should be aligned.

Because of this mindset, we are careful not to take undue risks. This has held us in good stead in rising rate environments, as our willingness to be more defensive in the prelude has allowed us to be more opportunistic after selloffs in the market.

We manage like we’ve been here before, because we have.

The current leadership has been in place since 1989 and we’ve been navigating a variety of rate environments since before the Tequila crisis, which sparked a sell-off in the emerging markets and pushed 10-Year Yields up from 5.7% to nearly 8% in 1994.

During the Taper Tantrum in 2013—when investors grew nervous as the Fed signaled it might soon end its ‘quantitative easing’ program—the Trust did what index funds and most active managers couldn’t: We kept some of our powder dry.

As our holdings were either called or came due, we chose not to redeploy all that cash into new bonds. This cushioned the effects of rising rates in 2013, and as the market stabilized, it allowed us to buy back into the market at lower prices to take advantage of these ‘air pockets’ in fixed income.

Our Current Thinking

Before rates began to rise last summer, we were again playing it safer than the indexes. We have been maintaining a relatively defensive stature—this time with a barbell approach to our portfolio.

The short end of this barbell is anchored with short- duration yield-to-call bonds. In fact, about 60% of the Trust’s holdings are set to mature or be called within three years, reducing the Trust’s rate risk. As securities are called or mature, we can reinvest selectively into higher-yielding debt, something other managers who hug the indexes couldn’t.

This helps explain why year to date through mid-March, our fund is up more than 3.5% while the average High Yield fund has been largely flat, and the broad market is down 3.5%. Another factor helping in this environment is our strategy at the other end of the barbell, where we can take some calculated risks among higher-yielding, longer-duration, out-of-index securities. We’re able to take those bets precisely because of our defensive posture at the other end of this barbell.

There’s one more advantage—size. As a mid-sized active manager in the High Yield space, we can go after smaller out-of-index securities with higher coupons, unlike giant active managers like Vanguard High-Yield Corporate. And that’s precisely what you want from a manager when rates rise: the freedom to be active, nimble, and opportunistic.

Click here to read a PDF of our article.

Bruce H. Monrad is chairman and portfolio manager of Northeast Investors Trust (ticker: NTHEX), a no-load, high-yield fixed income fund whose primary objective is the production of income. Bruce is among the longest-tenured bond fund managers, having run Northeast Investors Trust for more than 30 years. He received his A.B. from Harvard College and his M.B.A. from Harvard Business School.

CONTACT: 1-800-225-6704 (M-F 9:00am – 4:45pm EDT); bmonrad@northeastinvestors.com

Join our email list to get the latest informed news and commentary from Northeast Investors Trust.

DISCLAIMER: From time to time a Trustee or an employee of Northeast Investors Trust may express views regarding a particular company, security, industry or market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of the Trust or any other person in the Northeast Investors Trust organization. Any such views are subject to change at any time based upon market or other conditions, and Northeast Investors Trust disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for Northeast Investors Trust are based on numerous factors, may not be relied on as an indication of trading intent on behalf of the Trust.